Re-energising our industry: Yondr’s global head of energy talks trends for 2022

By: Ross McConnell

I’m going to start with something you already know: we can no longer rely on fossil fuels to keep our world running.

As global head of energy at Yondr, the changes I expect to see in 2022 will be guided by the growing use of electricity and increasing demand for decarbonisation.

The data center industry is in a paradoxical position to tackle this challenge. We have an overwhelming need for power. But we also have the capital and the industry presence to set a precedent for hitting ambitious sustainability targets.

Here are my top three energy predictions for 2022.

Trapped between a rig and a hard place

Following COP26, more than 40 countries have now committed to phasing out coal power – a central tenet of the conference but a challenging dichotomy (Harvey, Ambrose, Greenfield, 2021). The International Energy Agency (IEA) predicts demand for electricity will grow next year by four percent, with 40 percent of that demand met by fossil fuels (IEA, 2021). Can the two realities coexist?

Right now, renewables alone can’t provide baseload generation to maintain consistent function on the grid. And in the shadow of extreme weather unbalancing the grid (Chang, 2021), the right energy mix is critical. This is further complicated by the exponential increase in gas and power prices across the world.

As the grid power mix shifts to a higher concentration of renewables, it presents an ever increasing challenge for the electricity system to manage intermittent renewable energy while gas and coal are squeezed out of the pool. Developing a range of flexible technologies such as battery storage will play a critical role. And of course, advocates of nuclear which is in effect carbon free will argue that it should increase its share or at least retain its share in the fuel mix but this technology is fraught with political and economic issues – a conversation for another day!

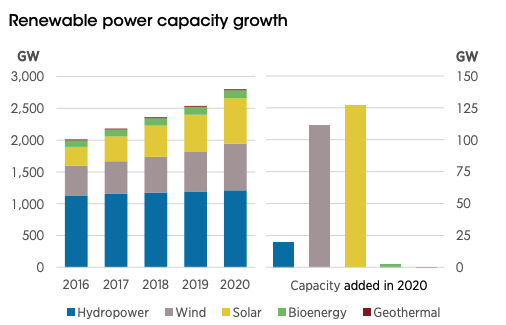

The good news is, we’re steadily increasing our capacity to generate electricity from renewable sources (IEA, 2021. See Figure 1). And the IEA expects to see that 2021 was a record-breaking year for new installations.

Figure 1: Source

However, if 2021 has taught us anything, it’s that we still cannot solely rely on renewables – yet! That’s why we will continue to have a greater dependence on natural gas. Experts such as the IEA are keen to stress that European governments should strengthen policies and regulations on natural gas storage – and seek to diversify their sources of supply. It’s a viable transition fuel on the way to green energy, however, it should only be a short stop on the road to more sustainable sources.

Giving smaller players the PPA leg up

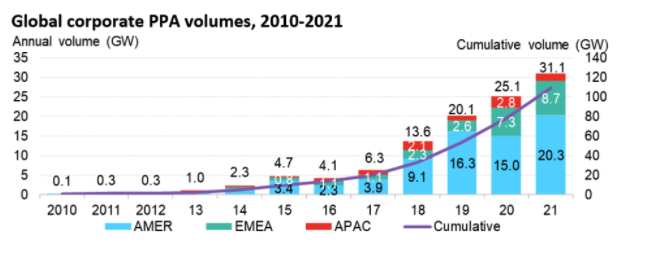

Through 2021, we saw a significant increase in corporate power purchase agreements (CPPAs), with 2021 another record year, see Figure 2. Companies in the commercial and industrial sector account for nearly two thirds of the world’s electricity demands, so the more CPPAs we see in these industries, the closer we get to achieving global energy transformation.

Figure 2: Global corporate PPA volumes, 2010-2021 Note: Onsite PPAs excluded. APAC volume is an estimate. Pre-reform PPAs in Mexico and sleeved PPAs in Australia are excluded. Capacity is in MW DC. Source: Bloomberg NEF

In many parts of the world, corporate power purchase agreements (CPPAs) have been a reliable way for large energy users to source and procure green energy from new renewable projects without the capital expenditure. Buyers are usually tied into 10-year contracts with generators securing a decade of renewable energy at a fixed price directly from the source.

Lenders who finance these agreements will seek as much certainty as possible, typically around tenure and price. However, there is an emerging trend of lenders in more mature renewable markets becoming more comfortable with risk and PPA deals with reduced tenures of three to five years gaining popularity.

For corporations, this means more access to flexible options for greening electricity, and a mechanism to hedge their electricity costs. This will surely be a welcome development given the recent surge in power prices internationally. Short term contracts are less daunting than 10-year commitments for many companies, especially smaller ones looking to get a foothold in the green energy space.

Another trend we’re likely to see is companies entering into CPPAs with existing renewable projects coming to the end of a contract, or exiting government subsidy contracts. This will occur in more mature renewables markets, where project owners will have likely paid their debt off and are open to shorter term contracts. Signing a PPA with an operational asset may not qualify as additionality but it does give companies access to a broader range of renewable power solutions on their pathway to sustainability. What’s more, there could be scope to repower these assets with greater, more efficient technologies that contribute to the clean energy transition. Germany is definitely one to watch and developments in this specific region might dictate future trends in other markets.

Data center developers as a green influence

Raising an eyebrow? Let’s see how the year pans out.

For the last decade, tech giants have been trailblazers in this space while working towards their 100% renewable energy targets, responsible for the addition of gigawatts of new renewable capacity through CPPAs. Some of the leading tech players have expanded on this by committing to be 24/7 carbon free by 2030. 24/7 hourly matching moves beyond buying enough renewable energy to match annual consumption, to matching consumption every hour of every day.

Of course, this is easier for some countries than others. Singapore, for example, relies on fossil fuels for 98 percent of their energy (Campbell, 2021). With electricity and data capacity demand expected to grow, they’ll need to bring considerable green energy to the grid to meet those targets.

Fortunately, they have a proven track record in bringing new renewable capacity (known as additionality) to the grid. Working to reach the carbon free target will undoubtedly incentivise investment in more technologies like battery storage which will prove useful while markets face flexibility challenges.

But as data center developers enter new markets, they have the opportunity to set the tone for investment. Investment that will favour renewable energy and accelerate the clean energy transition. And when the data center developers use their market position to encourage the adoption of green energy, everyone will benefit from a greener grid.

There’s a new way to look at energy consumption, and that’s as a catalyst for lasting change. It’s up to us in the data center industry to lead the charge.

References:

Harvey, F. Ambrose J. Greenfield, P. (2021, November 1). More than 40 countries agree to phase out coal-fired power. Guardian. https://www.theguardian.com/environment/2021/nov/03/more-than-40-countries-agree-to-phase-out-coal-fired-power

IEA (2021, July 15). Global electricity demand is growing faster than renewables, driving strong increase in generation from fossil fuels. IEA. https://www.iea.org/news/global-electricity-demand-is-growing-faster-than-renewables-driving-strong-increase-in-generation-from-fossil-fuels

Chang, A. (2021, February 20). Why the cold weather caused huge Texas blackouts – a visual explainer. Guardian. https://www.theguardian.com/us-news/2021/feb/20/texas-power-grid-explainer-winter-weather

IEA (2021, December 1). Renewable electricity growth is accelerating faster than ever worldwide, supporting the emergence of the new global energy economy. IEA. https://www.iea.org/news/renewable-electricity-growth-is-accelerating-faster-than-ever-worldwide-supporting-the-emergence-of-the-new-global-energy-economy